Our Why?

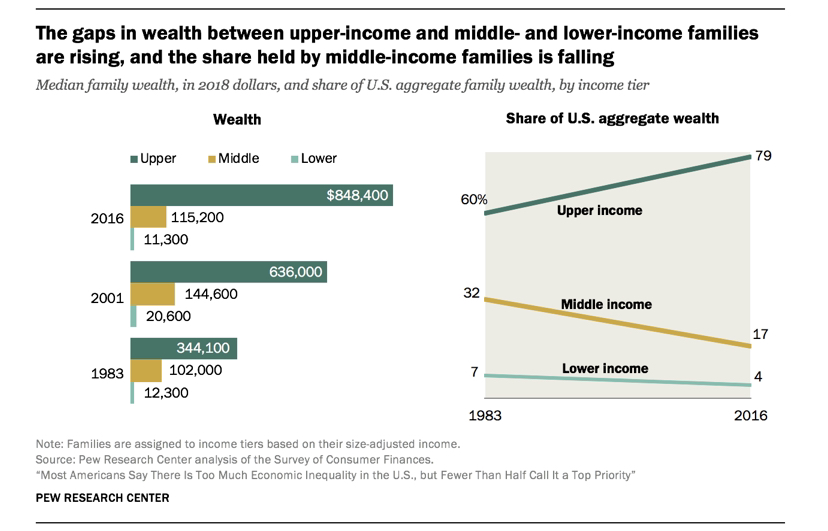

From 1979-2019, income inequality IN THE UNited states grew by 25% which equated to 69% of the Total wealth being owned by the Top 10%. In short, the rich are getting richer while those in the lower and middle classes are becoming poorer. We are changing that through youth-based financial literacy education.

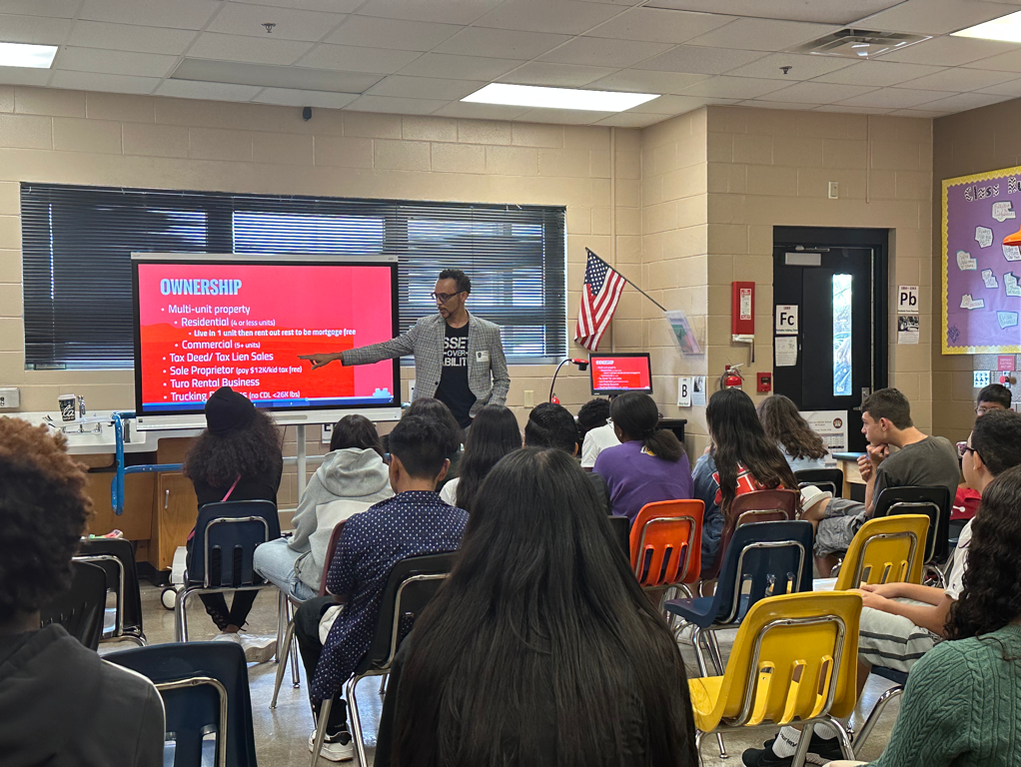

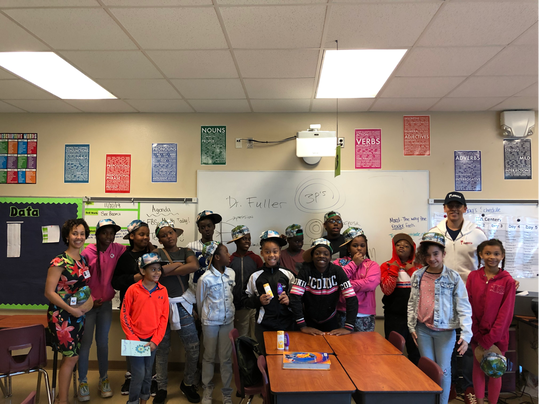

OUR FINANCIAL LITERACY FESTIVAL

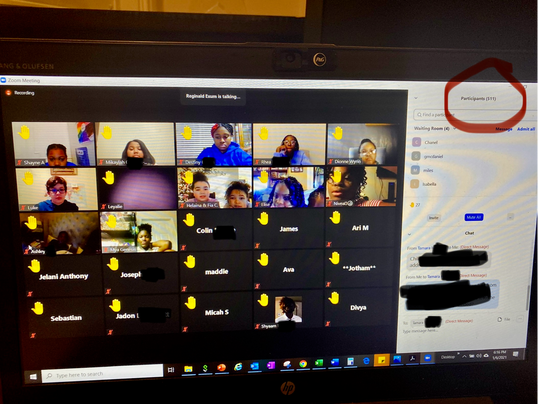

OUR ONLINE CLASSES

OUR EDUCATIONAL MUSIC |

|

What is the wealth gap?

What is financial literacy?

The knowledge and understanding of financial concepts and risks, and the skills, motivation, and confidence to apply such knowledge and understanding in order to make effective decisions across a range of financial contexts, to improve the financial well-being of individuals and society, and to participate in economic life.

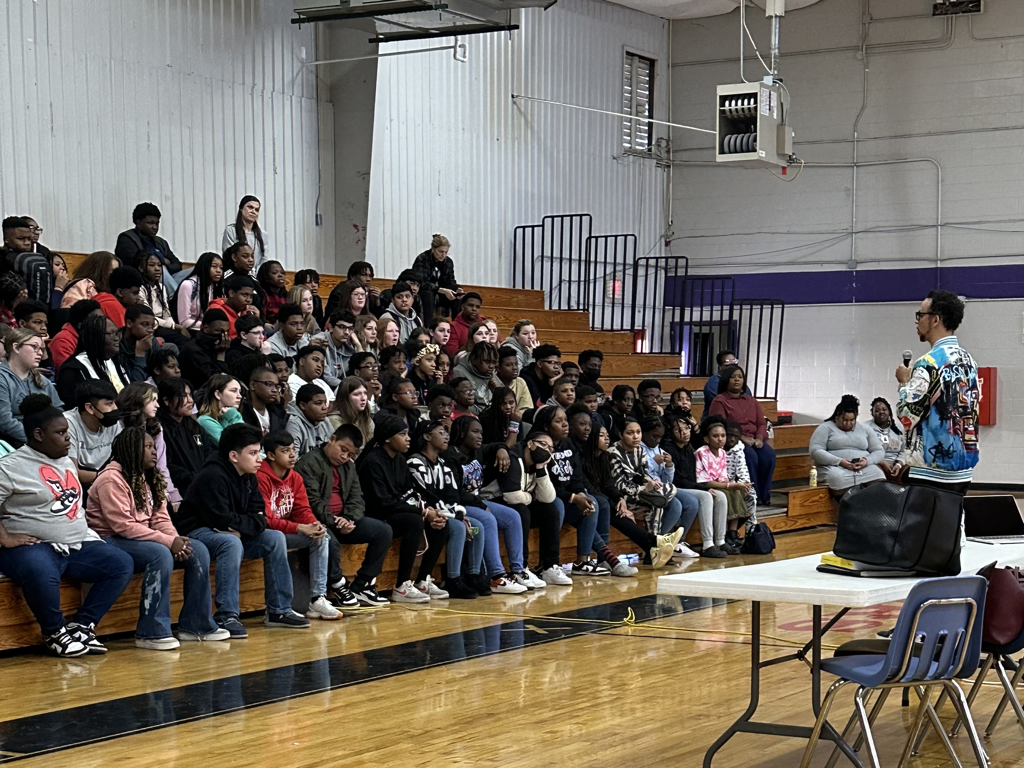

OUR MISSION

Our mission is to impact the wealth and knowledge gap by teaching the youth about financial literacy, leadership, and multigenerational change strategies.

Our mission is to impact the wealth and knowledge gap by teaching the youth about financial literacy, leadership, and multigenerational change strategies.

our solutions

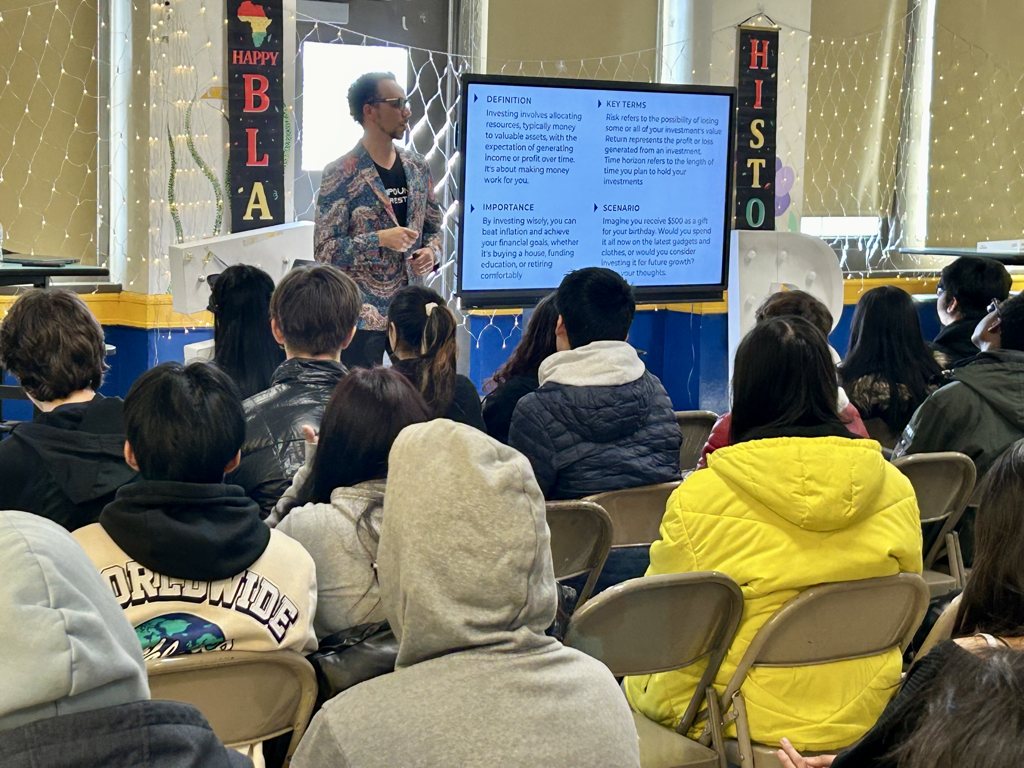

What we teach

S.M.A.R.T. BUDGETING * INVESTING VS SAVING * PHILANTHROPY * HOW TO EARN * ENTREPRENEURSHIP * IMPACT OF CREDIT * LEADERSHIP * TAXES * HOW TO SPEND * STOCKS VS ETF’S * BANK ACCOUNTS * OWNERSHIP VS CONSUMERSHIP * CREDIT CARDS * IMMEDIATE VS DEFERRED GRATIFICATION * INTELLECTUAL PROPERTY * PASSIVE INCOME * COMPOUND INTEREST * EMPOWERMENT * 529 COLLEGE PLANS * ASSETS VS LIABILITIES * REAL ESTATE * 401K PLANS * NEEDS VS WANTS * AND MORE!

Celebrity Supporters

|

|

|

|

|

|

|

MEET OUR PANELISTs

RESOURCES

We believe the compound interest calculator is one of the most underutilized tools in education. For example, money earns roughly 0.5% interest yearly in a bank savings account vs roughly 10% interest yearly on average if buying an ETF for the S&P 500 in the stock market. Use this calculator to see how saving vs investing plays out over 10 years compared to 25 or 50 years. You'll be blown away. Einstein called Compound Interest the 8th wonder of the world.

Compound Interest Calculator

RecommendEd books

RecommenDed videos

Recommended FinANCE games

COOL KIDS FUND INC. IS A 501 (C)3 NON-PROFIT AND CAN ONLY ACHIEVE OUR GOAL WITH THE ASSISTANCE OF GENEROUS DONATIONS FROM PEOPLE WHO CARE ABOUT KIDS. WITHOUT THESE DONATIONS, PROVIDING SUPPORT TO KIDS THROUGH FINANCIAL LITERACY WOULD NOT BE POSSIBLE. VISIT THE IRS TO VIEW OUR NON-PROFIT STATUS.